Nathan Bomey’s column at AnnArbor.com asks where are the Borders Brothers now that their namesake company is foundering?

I learned from his column that, in the first place, Tom and Louis Borders sold the company to Kmart Corp. almost 20 years ago and have had no role in its management since. In the second place, they rarely make public statements about Borders. So asking such a question is purely a contrivance to fill a column – but intriguing just the same:

As the book store chain that bears their name approaches bankruptcy, brothers Tom and Louis Borders are nowhere to be found.

That’s partly because they left Ann Arbor years ago. Louis is an entrepreneur in Silicon Valley, and Tom is involved in a financial business in Austin, Texas.

The Louisville natives started Borders Book Shop on South State Street in 1971. After Louis developed innovative inventory management software, the company transitioned into expansion mode. In 1992, the brothers sold it to retailer Kmart Corp. and stepped out of management of the company.

At the time, Borders had just 21 stores. Today, the company has 25 times as many Borders stores — an extremely costly footprint that is expected to drive Borders Group Inc. into bankruptcy as early as today.

Reading about the establishment of a Ann Arbor bookstore on State Street in the early 1970s prompted memories of my visits to the city in late 1974/early 1975 when Ross Pavlac and I visited Ro and Lyn Nagey. I seemed to remember that State Street was the setting for Ro to spring a little joke on us out-of-towners when we decided to go out for pizza.

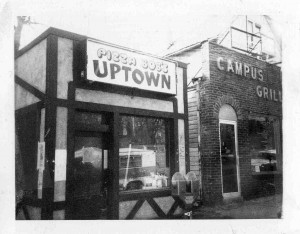

We piled into the car and Ro said he was taking us to Pizza Bob’s – and would we rather go to Pizza Bob’s Uptown or Pizza Bob’s Downtown? I naively asked which was closest and Ro said they were each about the same distance from his house. So I arbitrarily picked Uptown. We went there and had our meal.

On the way out Ro asked, did we all want to walk over and see Pizza Bob’s Downtown? I’m not a great one for hoofing around town after I’ve just eaten but that hasn’t kept me from being roped into any number of fannish expeditions and I saw it was about to happen again. Ro led off. Then after taking only a few paces he suddenly stopped. And as proud as if he had arranged it himself he waved to the sign over the nearest building: Pizza Bob’s Downtown was just two doors away.

I checked online and was pleased to see Pizza Bob’s still exists at 814 S. State St., though apparently this was the “Downtown” location because Pizza Bob’s “Uptown” site has gone away.

Learning that the pizza place was in the 800 block of State Street I could see I was never terribly close to any of Borders’ early locations in the 200 and 300 block, and if we even drove past it would have been merely another one of Ann Arbor’s many bookstores.

[Thanks to Andrew Porter for the link to Bomey’s column.]